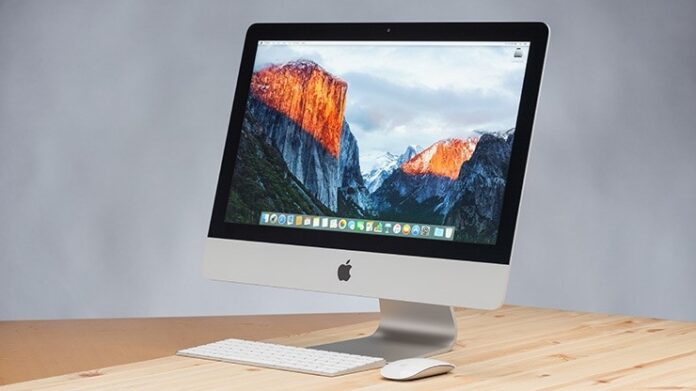

The Apple iMac Pro i7 4K, is the latest all-in-one desktop computer. It consists of all advanced features and new designs. It is the best computer for both command users and professionals. Every year Apple brings innovative ideas to the market of laptops and desktops. For several years the company have been releasing new iMacs with highly-advanced features. The company also improves the design of computers for older ones.

People who love technology always search for new gadgets with great features for better performance. For such technology freaks, the iMac Pro i7 4K is one of the best desktops in the Apple store. The Retina 4K display is the most proficient aspect of the gadget. This display has 4.5 times better resolution than of full HD display. Moreover, it also has an upgraded check panel, Bluetooth mouse and keyboard. Here in this content, you will get all the basic features and specifications for the iMac Pro i7 4K desktop.

What Are The Surpass Specifications Of Imac Pro I7 4K?

The specifications of the gadget are at par for professionals and for those who love to have the best characteristics of their gadget. Here we have collected all the specifications of the Imac pro i7 4K for the readers:

|

Name of the specification |

Required details |

|

Display |

4096x2304P, 21.5-inch Retina 4k display with IPS technology |

|

Processor |

8-Core Intel Core i7 |

|

Memory |

32 GB DDR4 |

|

Graphics |

Radeon Pro Vega 56 8GB GDDR5 |

|

Operating System |

Mac OS X |

|

Storage |

1TB SSD |

|

Connectivity |

1 Secure Digital (SDXC) slot, 1 Ethernet port, 2 Thunderbolts 3 (USB-C) ports, and 4 USB 3.0 ports |

|

Camera |

Built-in Face Time High-Definition Camera with 1080 pixels |

|

Weight |

21.5 pounds |

|

Wireless Card |

Air Post Extreme (802.11ac) |

|

Flash memory capacity |

256 GB |

|

Bluetooth |

4.2 Bluetooth |

Now let us look at the details of each specification of the Imac pro i7 4K:

Color Display Of The iMac Pro I7 4K Computer

This is the most striking feature of the iMac Pro i7 4K. The gadget has the most recent innovation of a 27-inch Retina 4K LCD with a resolution of 5120 x 2880 pixels. This supports P3 wide-colour gamut for a wider range of colors to display. This feature makes it the perfect tool for photo and video editing tasks. The display also features customers with 500 nits brightness for an exceptional viewing experience. In addition, users will also get an anti-reflective coating that reduces glare. It is a plus point to use this desktop in bright environments as well.

Moreover, to make a customized view you will get multiple scaling options and color-calibrated options as well. This becomes easy for professionals who need accurate color representation for their professional dealing. Its full sRGB and DCI-P3 color spaces allow it to virtually cover all the colors like displays of digital cameras and printers.

Processor Performance Of Imac Pro I7 4K

If we talk about the excellent processor of the iMac pro i7 4K, then it has an Intel Core i7-3GHz processor. IMac has provided this great powdered multi-core processor for professional users. Another powerful feature of the iMac Pro i7 has a quad-core processor that is designed for professionals who do any kind of scientific research, video editing and 3D rendering. This processor is powered by a 9th-generation Intel with a quad-core configuration. This shows that this desktop has four cores, which permits the user to handle multiple tasks simultaneously. Plus, it inputs more energy into the gadget and enhances its life.

Memory And Storage Capacity

Storage capacity is the specification where the Imac pro models stand out. The iMac Pro i7 4K gives 1TB SSD storage capacity and a 5400 RPM drive to desktop users to ensure fast and reliable data storage. For exceptional performance, SSD storage supports NVMe protocol as well. 5400 RPM drive. It also possesses a compact PCIe flash memory disc with an integrated 1, 2, or 3 TB 7200 RPM hard drive. Furthermore, for the smooth run of applications IMac Pro i7 4K comes with 128GB 2666 MHz DDR4ECC memory.

Graphics of the iMac Pro

Having this gadget in your profession, you can plan to upgrade your graphics card capabilities on your iMac Pro with two options:

- First is the Radeon Pro Vega 56 (8GB HBM)

- Second is the Radeon Pro Vega 64 (16GB HBM2)

Moreover, you can also have easy access to the RAM ports of the iMac Pro i7 4k desktop. With all these graphic features you can have the best experience of intense gaming and video editing. In addition, hardware-accelerated ray tracing is also supported by the graphics card of this gadget to provide realistic lighting and shadows for 3D graphics.

Audio, Video, And Camera Features

Detailing of audio and video panels of Imac pro i7 4K completes the review of the gadget. These aspects are pretty inspiring for the user. The Apple iMac Pro i7 4k possesses three video outputs and one FaceTime camera with high definition. What’s more, it has two external displays with 2160 x 3840 pixels and two with 2304 x 4096 pixels. You will also get a native visual connectivity output through a USB-C port. Users can also use the converters to support the two thunderbolts, DVI, VGA, and HDMI outputs. Plus, the webcam of the device gives a realistic image with perfect clarity for making the satisfied video call conferencing. Here is the list of audio facilities that the user will get in the iMac Pro i7 4K:

- Microphones with the high-end sound quality

- 4 USB-A ports to attach external devices like speakers

- 1 SDXC SD slot

- A perfect sound system for a smooth audio experience

- 1 3.5mm headphone input for a personal mic experience

- Extremely efficient small Apple speakers for a perfect sound setup

Connectivity With External Devices

The iMac Pro i7-4K provides plenty of connectivity options including 1 Secure Digital (SDXC) slot, 3 USB 3.0 ports, 4 Thunderbolt3 ports and a 10 Gigabit Ethernet connection. You can connect your external peripherals, accessories, and external storage devices for better performance as per the requirements.

Operating System Of Imac Pro I7 4K

The desktop is pre-installed with macOS, which is the latest version of Apple’s operating system iMac Pro i7 4K. This OS have an instinctive and user-friendly interface to access files, apps and user data easily. In addition to this, the operating system has ample fantastic built-in features and apps, such as a photo editing app, the iMovie editor and the Siri virtual assistant for making communication better.

How About The Imac Pro I7 4k Price?

The Apple iMac Pro i7 4K is the most advanced and dominant desktop computer for computer lovers. The model has a well-built processor with a high-end Radeon Pro Vega 56 graphics card. Thus, it becomes an outstanding choice for innovative users who require 4K resolution for their work. If we talk about the iMac Pro I7 4K price then it will cost you around $1299 to $1699 depending upon the configurations and external devices to buy.

This can be a bit precious like other Apple devices, but when you will look at the features of the gadget then you will realise it is worth buying for your professional work. You can run the most demanding programs and games smoothly on this device. As a result, this becomes an excellent choice for users who are looking for a powerful desktop computer.

After pondering upon all the superb features of the iMac Pro I7 4K desktop you will come to know that the price of the desktop is extremely reasonable as compared to other notebooks of similar nature.

What Is The Rating Of Imac Pro I7 4K?

The iMac Pro i7 4K desktop is a versatile and controlling device for professionals and gamers. Its i7 processor provides features of video editing at lightning-fast speeds. Its 4K display is an excellent medium for photo editing, watching HD films and playing heavy 3D games. Apart from these features, because of its sleek design it has maintained its position in the user’s heart to handle easily.

If we look at the price ratings of Imac devices then iMac Air is more affordable than iMac Pro i7 4K. However, the storage of later is quite impressive, and it can store four times more than the previous Apple versions. The device’s screen rating is also amazing in terms of an edge-looking visual appearance.

Is The Imac Pro I7 Worth buying?

When it comes to technology, you can find something newer and better all the time. Keeping this in mind Apple has upgraded its Imac with some impressive claims to handle any task you throw. The appliance is worthwhile for photo editors and intense gamers who need high resolutions in their devices for smooth functioning. Imac pro i7 4K price is a bit high with features of 8 cores, 32GB RAM, and 1TB SSD storage. If money isn’t an issue for you at the cost of the specifications given by Apple then this is the excellent choice for you depending on your specific needs.

Another factor to consider before buying is the performance of your daily routine. If you do not require a lot of horsepower for your daily work, then an iMac Pro might be overkill for you. Next comes the consideration of graphics and design that could match your personality and style of work.

How Does The Design And Build Quality Attracts The Customers?

Overall looks of this iMac are impressive and attract a lot of customers. It is a blend of Apple’s signature and style. Apple brand has taken the ‘Pro’ in iMac Pro i7 sincerely and made a sleek and classy Space Grey finish. The sleek and stylish design is made of first-rate aluminum, with borders less than 0.2 inches thick, giving the slimline look to impress.

The complete design of the iMac pro i7 4K computer is clean and minimalistic. All of its ports are located on the rear of the desktop which makes cable management much easier and keeps your desk clutter-free. There is a 1080p HD webcam above the screen and the machine is equipped with four microphones, Bluetooth 4.2, Wi-Fi and a 10 Gbps Ethernet connection.

Final Verdict Of Imac Pro I7 4K Desktop!!

The iMac Pro i7 4K desktop is a dominant, resourceful all-in-one computer that offers outstanding performance. It has a stunning display, sturdy processor and graphics, and huge storage capacity, making it an ideal choice for several demanding tasks including software development, 3D rendering, intense gaming and video editing. All things considered, the iMac Pro i7 4K will provide you with a great computing experience regardless of your profession.

FAQs Related To Imac Pro I7 4K

What is the Apple iMac Pro i7 4k price for the buyer?

The Apple iMac Pro i7 4k desktop is more pricey than its predecessor and will cost you around $1299 to $1499.

How many gigabytes of RAM does an Apple iMac pro i7 4k have?

The device provides a remarkable amount of storage space with 8 GB RAM and its 3 TB hard drive.

What kinds of external connections are available with the iMac pro i7 4k desktop?

The Apple iMac Pro i7 4k equip with an 802.11 WiFi connection and is also compatible with Bluetooth version 4.2.

Is the iMac Pro i7 worth buying?

If you are a professional gamer, photo editor, graphic designer, or software developer or have a demanding workload then it is a great choice for you.

Does The iMac Pro have a 4k display?

Yes, the iMac Pro i7 4k has a 4k display variant that is the best choice for people who are in a profession to work on high resolution.

Is iMac a good choice for photo editing?

Buying an iMac pro i7 4k for the photo editing profession is worth it. It will proffer a large, high-resolution display with powerful hardware to professional photographers.

Is the iMac offer a 4K or 5K screen resolution display?

Apple iMacs come in both 4K and 5K screen resolutions. In a 4K iMac, you will get a resolution of 4096 x 2304 pixels, while in a 5K iMac, it is 5120 x 2880 pixels. The higher resolution of the 5K iMac is even sharper and more vivid for high-precision works.

How much faster is an iMac Pro i7 than an i5?

As i7 processors are known for their higher clock speeds, more cores, and much faster turbo boost capabilities. So, the improved version of Apple with an i7 processor can lead to quicker data processing, faster rendering and enhanced multitasking potential.

How long will the iMac Pro i7 be supported?

Based on the support of the operating system the limit is between eight and ten years. After this period Apple will not support the software.

Is the Apple brand releasing a new iMac in 2023?

As per Bloomberg’s newsletter, Apple brand has no plans to launch a new 24-inch iMac until late 2023.

Related Posts:

![Best Samsung 5G Phones Under ₹30,000 in India – Latest Models & Reviews[May, 2025] Samsung A35 5g](https://appeio.com/wp-content/uploads/2025/02/Samsung-smartphones-under-30k-356x220.webp)

![Top 4 Best Samsung Phones under 40000 [April,2025] Top 4 Best Samsung Phones under 40000](https://appeio.com/wp-content/uploads/2021/05/Top-4-Best-Samsung-Phones-under-40000.jpg)